401k cash out penalty calculator

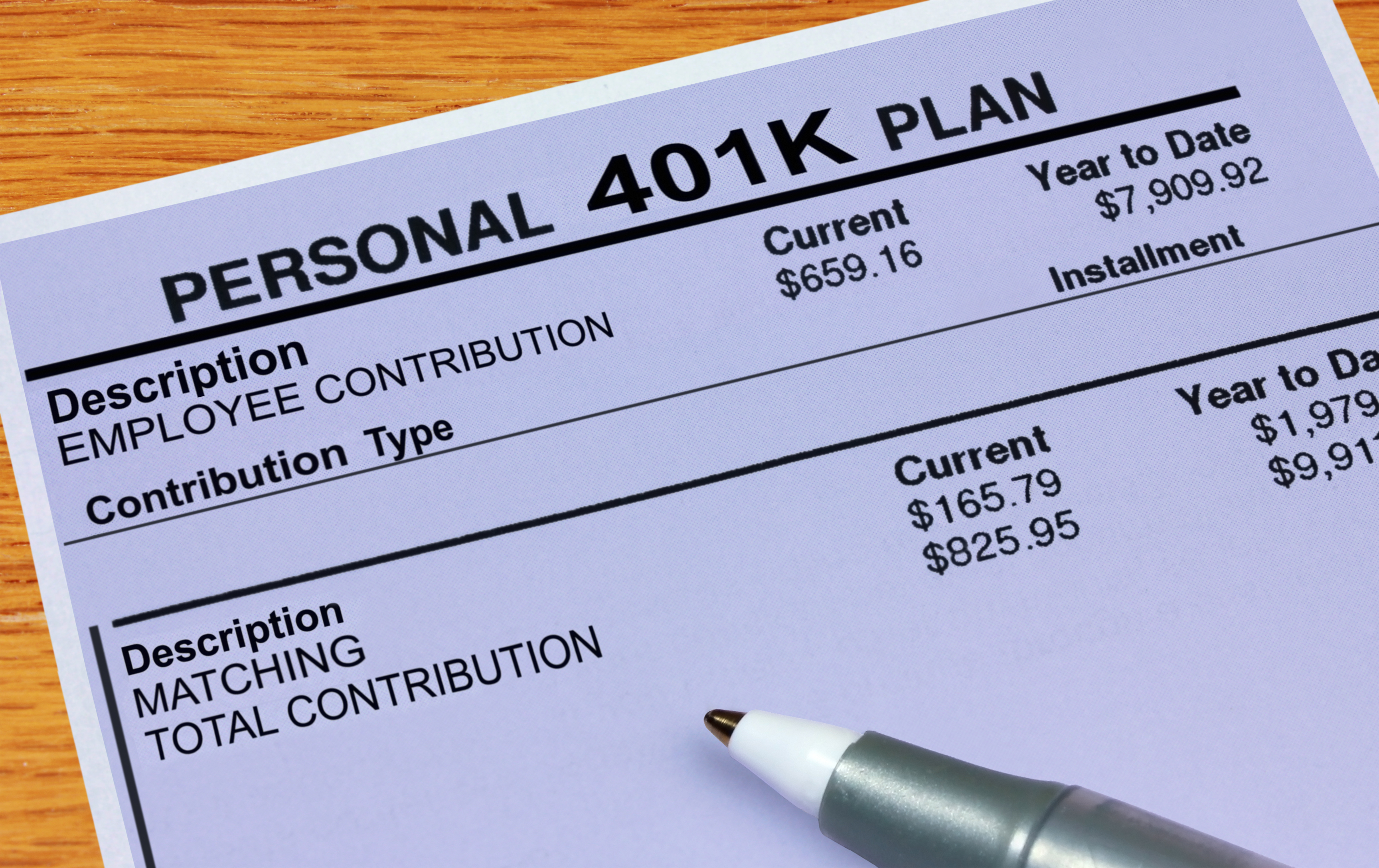

Traditional or Rollover Your 401k Today. If your account is worth 50000 and youve made 10000 in nondeductible contributions you can determine that the nondeductible portion is 20 or 02.

Beware Of Cashing Out A 401 K Pension Parameters

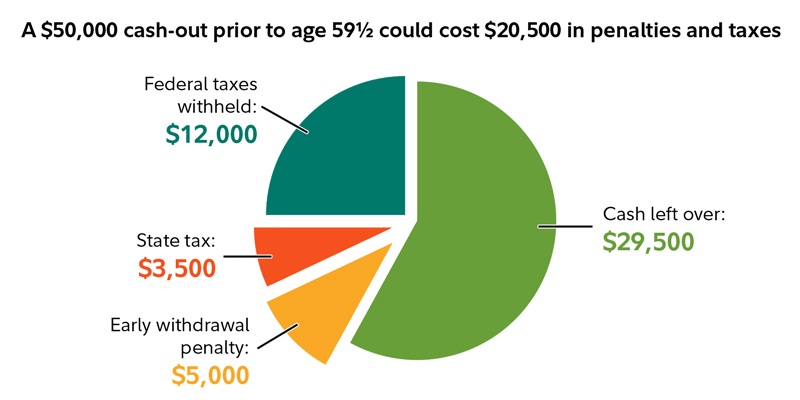

This is a hypothetical illustration used for informational purposes only and reflects 10 federal income tax rate and 0 state income tax rate plus a 10 IRS early withdrawal penalty on the.

. Penalties And Taxes On Cashing Out A 401k. Try Our Calculator Today. The reality is IRAs tend to have more lenient withdrawal rules so one of the ways you may be able to withdraw from your 401k without paying a penalty is to first convert your.

While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that. Ad If you have a 500000 portfolio download your free copy of this guide now. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

So if you cash in 2000 then you would only receive around 1600. A good rule of thumb is to expect to lose about half of your money to taxes and penalties at the federal and state levels. Everything You Need to Know About Planning for Your Retirement.

If you withdraw money from your 401 k before youre 59½ the IRS usually assesses a 10 penalty when you file your tax return. The IRS will penalize you. So if you take 20000 out of your 401k before you reach 59 12 youll.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Most times when you cash out only 10 of the. When you complete a 401k cash out you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal.

55 or older If you left. Withdrawing before the age of 59 ½ will probably result in 20 of the withdrawn amount being withheld. If you start taking money out of your 401k early youll pay taxes of 20 percent of what you withdraw.

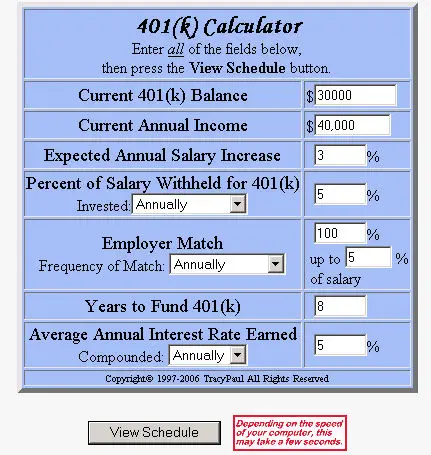

The calculator inputs consist. Open an IRA Explore Roth vs. In general distributions prior to age 59½ will be hit with a 10 penalty and income taxes.

When considering making an early withdrawal from your retirement savings it is important to understand the potential impact of such a decision. Ad Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

Once you contribute to a 401k you should consider that money locked up for retirement. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401 k or even your IRA versus rolling it over to a tax. This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account.

It allowed withdrawals of up to 100000 from traditional or Roth 401k for 2020 only without the 10 penalty for those under age 59½.

Pin On Buying Selling A Home

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Should You Withdraw Funds From Your 401k The Ifw

Covid 401k Withdrawal 2021 What You Need To Know The Us Sun

Cashing Out Your 401 K What You Need To Know

Retirement Accounts A Comprehensive Guide Meld Financial

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401 K Calculator Credit Karma

How To Roll Over Your 401 K To An Ira Smartasset

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Free 401k Retirement Calculators Research401k

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

401 K Withdrawal Calculator Nerdwallet

401k Calculator

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps